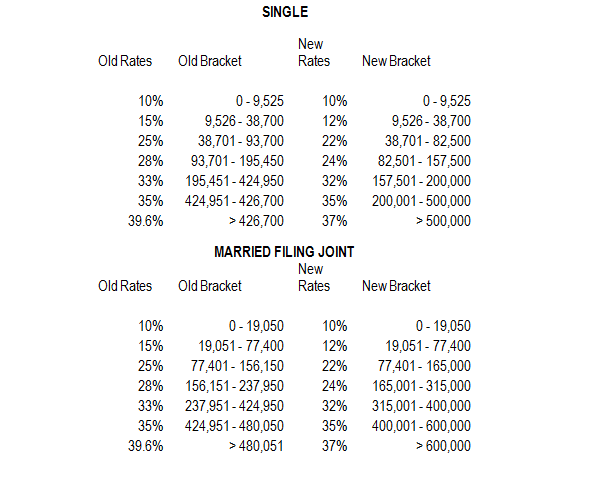

Tax Cuts & Job Act

Key Points & 2017 Year End Tax Planning in Wake of the Tax Reform Legislation Strategies to consider before December 31, 2017: If possible, pre-pay estimated state taxes accrued in 2017. For example: 4th quarter estimated tax payments to the State of Georgia paid in 2017 will be deductible. Pay 2017 property taxes in 2017. The […]