Tax Cuts & Job Act

Key Points & 2017 Year End Tax Planning in Wake of the Tax Reform Legislation

Strategies to consider before December 31, 2017:

- If possible, pre-pay estimated state taxes accrued in 2017. For example: 4th quarter estimated tax payments to the State of Georgia paid in 2017 will be deductible.

- Pay 2017 property taxes in 2017. The state and local tax deduction (“SALT”) remains in place for those who itemize their taxes — but now there’s a $10,000 cap. Previously, filers could deduct an unlimited amount for state and local property taxes, plus income or sales taxes. For example: If you still owe Fulton County or City of Atlanta property taxes for 2017 – try to pay them before the end of the year.

- Defer business income if possible to 2018, when rates are lower and deduction for portion of pass-through entity business income becomes effective.

- Recognize business losses in 2017 – deductions will be limited in 2018.

- Considering large purchase of eligible property? Section 179 deduction increases dramatically in 2018.

- Electric Car Credit expires at year-end 2017; considering a purchase? Act now. Considering a luxury car purchase? Defer to 2018, when allowable depreciation increases substantially.

- Miscellaneous itemized deductions (such as unreimbursed employee expenses, investment fees, tax prep fees, etc.) will not be deductible next year. Consider prepaying 2018 fees now.

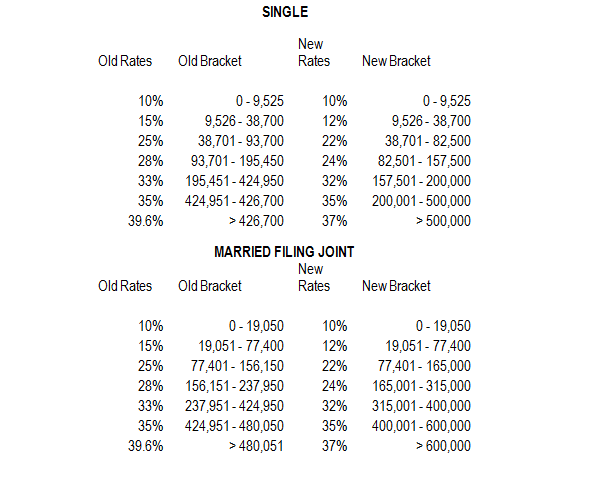

Changes to individual income tax rates:

There will still be seven tax brackets based on income; however, the rates for some of these brackets have been lowered. Changes in Rates and Allowable Deductions:

- Individual changes expire in 2026 absent future changes by Congress

- The standard deduction has been significantly increased. For single filers, the standard deduction has increased from $6,350 to $12,000; for married couples filing jointly, it’s increased from $12,700 to $24,000.

- The Child Tax Credit has been expanded. The child tax credit has doubled from $1,000 to $2,000 for children under age 17. It’s also now available, in full, to more people. The entire credit can be claimed by single parents who make up to $200,000, and married couples who make up to $400,000.

- 529 accounts can now be used to save for elementary, secondary and higher education.

Selected Business Tax Changes in Act:

- Like-Kind Exchanges – No longer available for personal property (limited to real property); partnerships that elect out of subchapter K now have owners treated as owners of interest in the assets, not the partnership.

- Business Entertainment expenses – no longer deductible

- Bonus Depreciation – 100% of property placed in service through 2022, then phases out

- Section 179 expensing election increased to $1,000,000; definition of eligible property for election expanded to include (for nonresidential real estate) roofs, HVAC, fire protection and alarms, security systems

- New limits on interest expense deduction do NOT apply to real estate development, redevelopment, construction or reconstruction, acquisition, conversion, rental, operation, management, leasing or brokers.

- NOL carrybacks eliminated (except for farmers) but carryovers will be indefinite (limited, however, to 80% of taxable income)

- New C corporation tax rate is now flat 21%.

Estate and Gift Tax Changes:

- Temporary increase of tax-free threshold from $5.5 million to $11.2 million; however the increase expires in 2026 (absent additional legislation).

The information outlined above constitutes a summary of a few key provisions of the new Tax Cuts & Job Acts and includes a few year-end steps that can be taken to save taxes. Please contact us if you would like for us to tailor a particular plan that will work best for you or to discuss any potential tax-saving opportunities.